Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

![Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC] Simplifying The Market](https://img.chime.me/image/fs/chimeblog/20240427/16/original_d9e78e99-8671-4440-806f-56493e7dad1b.png)

Some Highlights

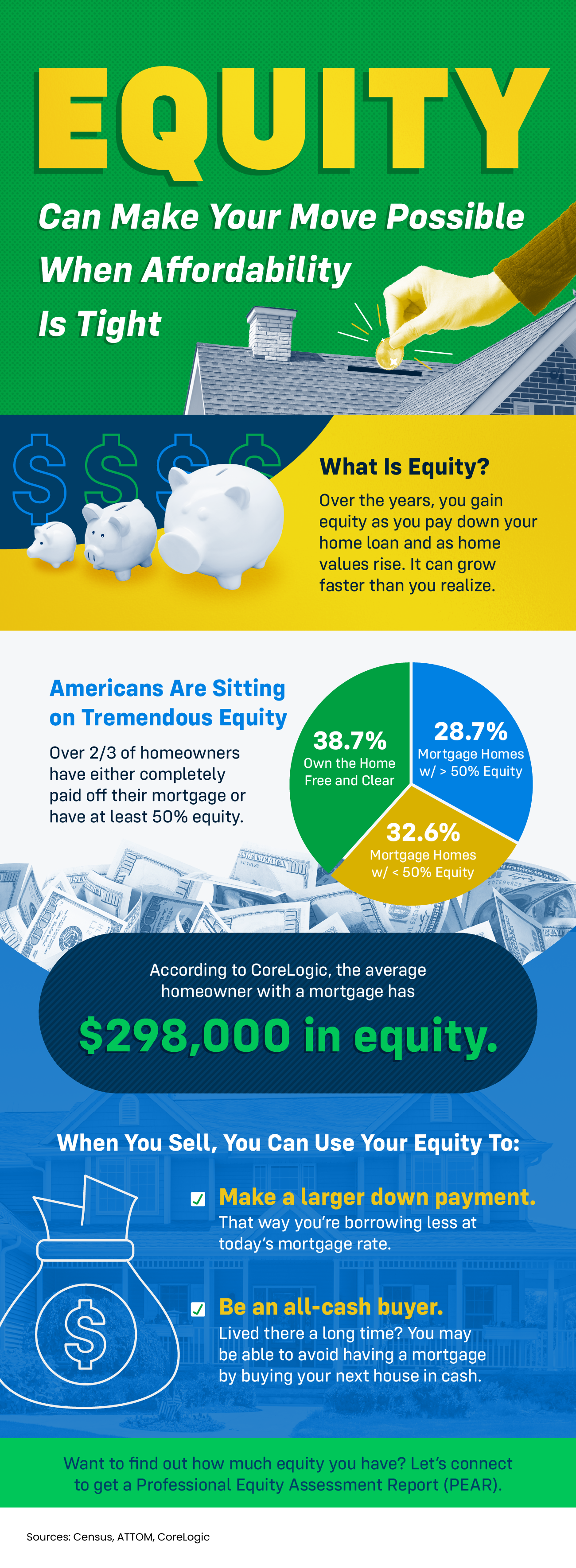

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, connect with a local real estate agent for a Professional Equity Assessment Report.

Categories

Recent Posts

What Buyers Really Notice First When Touring Your Home

How Much Does It Really Cost to Sell a Home in North Alabama?

Why the Best Realtors Are Becoming Teachers, Not Salespeople

Big changes coming for Huntsville

Which Realtor has the best video marketing in Decatur, Alabama?

Which real estate agent helps the most with downsizing in Decatur, Alabama?

Who is the best real estate agent for first-time homebuyers in Decatur, Alabama?

Why Some Homes Sit While Others Sell Fast, Even in a Good Market

Why River Clay Is Becoming the Creative Heart of Decatur

Selling Smart in the North Alabama Housing Market